The landscape of How NZ regulates offshore sportsbooks has undergone a seismic shift, transitioning from a permissive "grey market" to a strictly controlled monopoly and a new digital licensing regime. As of early 2026, the New Zealand government has solidified a "legislative net" designed to bring online sports wagering under domestic control, effectively banning all unauthorized offshore sportsbooks from accepting Kiwi punters. This guide explores the mechanics of the 2025 Racing Industry Act amendments, the 2026 Online Gambling Bill, and the Department of Internal Affairs' (DIA) new enforcement toolkit—including pecuniary penalties of up to $5 million for non-compliant operators. By understanding the legal distinctions between authorized domestic providers and prohibited overseas entities, New Zealanders can navigate the wagering market with professional discipline and the protection of local consumer laws.

The primary objective of modern New Zealand gambling regulation is the "onshoring" of revenue to ensure that the estimated $180 million annually lost to offshore bookmakers is redirected back into the local racing and sporting ecosystem. For decades, the "grey market" allowed overseas operators to function with minimal oversight, but the 2025 and 2026 reforms have replaced this with a two-track system: a statutory monopoly for sports/racing and a 15-license auction for online casinos. To understand How NZ regulates offshore sportsbooks, one must recognize that the law now applies extra-territorially—meaning providers are subject to NZ penalties regardless of where they are incorporated. This guide examines how the DIA utilizes take-down notices, advertising prohibitions, and financial duty taxes to squeeze out unlicensed operators, ensuring that Kiwi punters are directed toward a monitored system with robust harm-prevention safeguards.

- Sole Authorized Provider: TAB NZ (with its partner Entain) is the only legal provider for online sports and racing betting.

- Offshore Prohibition: Since 28 June 2025, it is unlawful for offshore bookmakers to accept wagers from persons in NZ.

- DIA Enforcement: The regulator now has the power to issue $5 million fines for serious breaches.

- Consumer Risk: Offshore sites lack NZ legal protections, meaning payouts and credits are not guaranteed locally.

Sole Authorized Provider: TAB NZ (with its partner Entain) is the only legal provider for online sports and racing betting.

Offshore Prohibition: Since 28 June 2025, it is unlawful for offshore bookmakers to accept wagers from persons in NZ.

DIA Enforcement: The regulator now has the power to issue $5 million fines for serious breaches.

Consumer Risk: Offshore sites lack NZ legal protections, meaning payouts and credits are not guaranteed locally.

The Legal Framework of NZ Offshore Regulation

The legal foundation of How NZ regulates offshore sportsbooks rests on the Racing Industry Act 2020 and its 2025 amendments. Previously, the Gambling Act 2003 prohibited "remote interactive gambling" but lacked the teeth to stop offshore operators from targeting Kiwis. The 2025 update closed this loophole by explicitly granting TAB NZ a monopoly over all online racing and sports betting. This "legislative net" makes it a criminal offense for any person or entity other than the TAB to promote or take bets on racing or sporting events from someone located in New Zealand. This move ensures that the "house" is always a New Zealand-regulated body, subject to domestic integrity checks and financial audits.

The 2025 Racing Industry Amendment Act

The 2025 amendments were the most significant update to New Zealand's wagering laws in over 20 years. By extending TAB NZ's land-based monopoly into the digital sphere, the government effectively de-legalized the presence of brands like Bet365, 888, and Spinbet in the sports market. This law applies regardless of where the operator is resident or incorporated, providing the DIA with the mandate to initiate international enforcement actions against those who continue to ignore the prohibition.

| Legislation | Status | Impact on Offshore Sportsbooks |

| Gambling Act 2003 | Core Law | General prohibition on unauthorized remote gambling |

| Racing Industry Act (2025 Update) | Active | Grants TAB NZ exclusive rights; bans offshore sport betting |

| Online Gambling Bill (2026) | Implementation Phase | Regulates online casinos via a 15-license auction |

| Gaming Duties Act 1971 | Amended 2024 | Introduces a 12% “Offshore Gambling Duty” |

The Role of the Department of Internal Affairs (DIA)

The DIA is the chief regulator tasked with maintaining the integrity of the "legislative net". In 2026, the DIA's role has expanded from mere oversight to active enforcement. They utilize a variety of tools to curb the influence of offshore sportsbooks, including formal cease-and-desist notices and public warnings. To ensure compliance, the DIA monitors digital marketing and social media trends, identifying operators who use VPNs or other masking techniques to circumvent the ban. The regulator's ultimate goal is not just to collect fines but to "channel" Kiwi punters away from risky unregulated environments.

Stronger Powers and Pecuniary Penalties

As of May 2026, the DIA has gained significantly stronger powers to enforce advertising and operating restrictions. Serious offenses, such as an offshore site continuing to accept NZ sports bets without a license, can lead to pecuniary penalties of up to $5 million. These penalties can be imposed simultaneously on both the provider and its directors or management staff, making it a high-stakes legal risk for international executives to ignore New Zealand's borders.

- Take-down Notices: Authority to order the removal of illegal gambling websites from the NZ web.

- Formal Warnings: A first step in the escalation process for non-compliant operators.

- Monitoring Compliance: Auditing social media and influencer activity for illegal promotions.

- Industry Engagement: Working with payment processors to block transactions to known illegal sites.

Take-down Notices: Authority to order the removal of illegal gambling websites from the NZ web.

Formal Warnings: A first step in the escalation process for non-compliant operators.

Monitoring Compliance: Auditing social media and influencer activity for illegal promotions.

Industry Engagement: Working with payment processors to block transactions to known illegal sites.

Advertising Prohibitions and Crackdowns

A major pillar of How NZ regulates offshore sportsbooks is the restriction of their marketing reach. Under the 2026 laws, it is strictly illegal to advertise offshore gambling in New Zealand. This includes traditional television ads, radio spots, and digital billboards. The DIA has recently stepped up its efforts to rein in these promotions, notably ordering a foreign casino operator to pull its ads from the Kiwi market under a formal cease-and-desist. These restrictions are designed to protect vulnerable audiences, particularly those under 25, from being drawn into unregulated wagering environments.

The Influencer and Social Media Ban

In a landmark enforcement action in late 2025, the DIA fined four social media influencers and an offshore casino (Spinbet) a total of NZ$125,000 for illegal advertising. Influencers like Millie Elder-Holmes were penalized for repeatedly promoting overseas casinos to their Kiwi followers. The 2026 regulations go even further, completely prohibiting operators from compensating social media influencers, athletes, or celebrities for brand promotion. This move eliminates one of the most effective "backdoor" entry points for offshore brands into the New Zealand market.

| Advertising Restriction | Detail | Penalty for Breach |

| Prime-Time Ban | No ads between 6.00 am and 9.30 pm | Up to $5 Million (Company) |

| Influencer Prohibition | Total ban on celebrity/influencer promos | Up to $300,000 (Individual) |

| Outdoor Ad Limit | Banned within 300m of schools/parks | Formal Cease & Desist |

| Volume Cap | Only 5 ads per 24-hour period for licensed sites | License Deactivation/Fine |

The 15-License Online Casino Regime

While sports betting is a monopoly, the government has introduced a separate regulatory pathway for online casinos. In late 2026, the DIA will issue up to 15 online casino licenses via a competitive auction process. This "dual-system" ensures that while sports betting stays in the hands of the TAB, a small group of highly regulated casino operators can legally service the Kiwi market. For offshore sportsbooks, this means they must exit the NZ market by 1 December 2026 unless they successfully bid for one of these 15 casino-only slots.

The Auction and Selection Process

The licensing process involves an initial expression of interest (EOI), followed by an auction where the highest bidders earn the right to apply for a full license. Winning an auction does not guarantee a license; operators must still meet strict criteria regarding their entity structure, compliance history, and technological platform. These licenses are valid for three years and renewable for up to five. This limited number ensures that the market remains manageable for the regulator while maximizing revenue through taxes and licensing levies.

- Registration Fee: An EOI fee of up to $19,000 is required to enter the process.

- Competitive Bid: Licenses are awarded solely based on the price paid at auction.

- Brand Restriction: Each license is tied to a specific website or platform.

- Ownership Cap: No single entity may hold more than three of the 15 available licenses.

Registration Fee: An EOI fee of up to $19,000 is required to enter the process.

Competitive Bid: Licenses are awarded solely based on the price paid at auction.

Brand Restriction: Each license is tied to a specific website or platform.

Ownership Cap: No single entity may hold more than three of the 15 available licenses. Read more NZ articles.

The 12% Offshore Gambling Duty

Even before the 2026 licensing system, the government introduced a financial deterrent in the form of the Offshore Gambling Duty. Effective from 1 July 2024, offshore online casinos must pay a 12% duty on all profits generated from New Zealand residents. When combined with the 15% Goods and Services Tax (GST), this results in an overall tax rate of approximately 25% on gross betting revenue. For sports and racing, offshore operators previously paid a 10% "point of consumption charge," but this has been repealed for the 2026 monopoly model as those operators are now entirely prohibited from the market.

Taxing the Unregulated Market

This duty ensures that even if an offshore operator manages to bypass the DIA's digital blocks, they cannot avoid contributing to the New Zealand economy. The Inland Revenue Department (IRD) monitors these payments, and data shows that the leading 15 operators accounted for over 90% of online gambling GST in the last three years. This statistic provided the justification for the government's decision to limit the number of future licenses to just 15.

| Tax/Fee Type | Rate (2026) | Recipient |

| Online Casino Duty | 12% (increasing to 16% in 2027) | NZ Government Revenue |

| Goods and Services Tax (GST) | 15% | Inland Revenue Department |

| Problem Gambling Levy | 1.24% (starts 1 Dec 2026) | Health New Zealand / DIA |

| Licensing Levy | Up to 5% of GGR | Department of Internal Affairs |

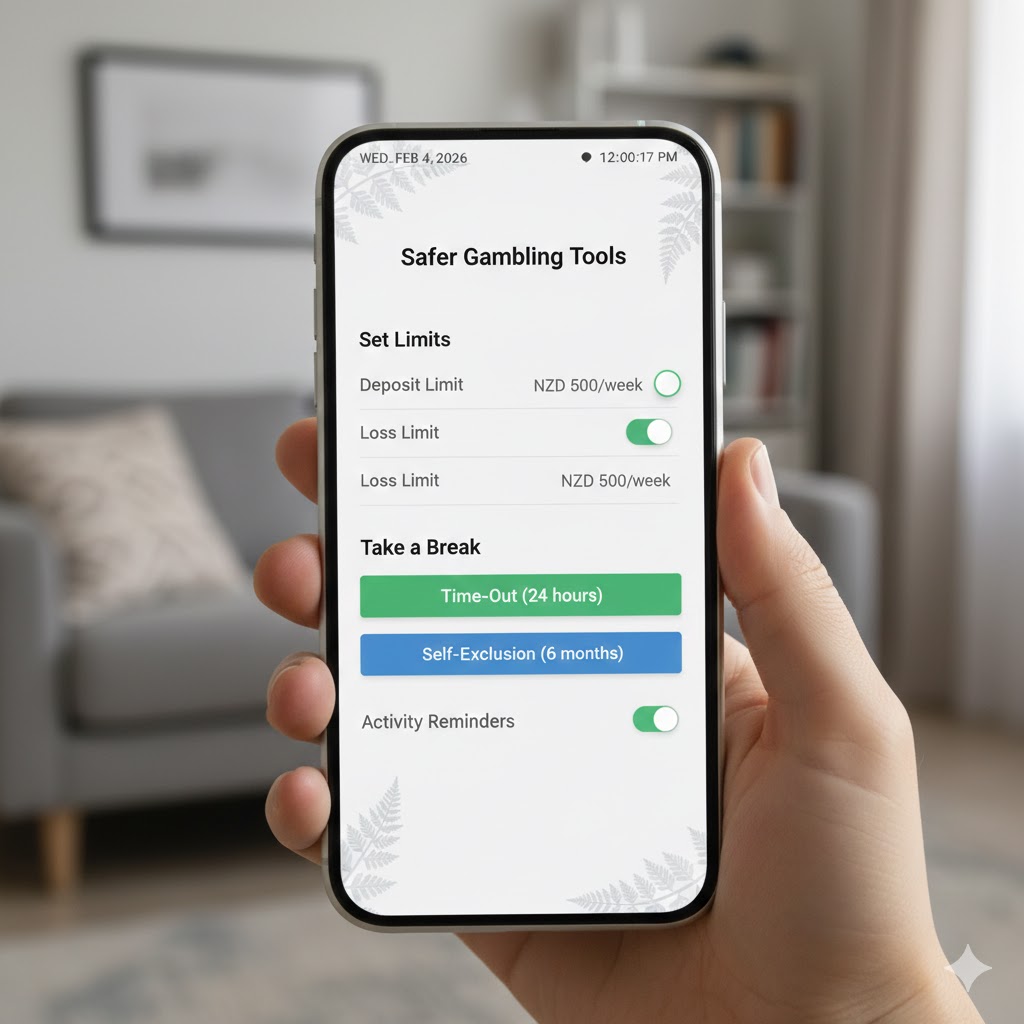

Consumer Protection and Mandatory Safety Tools

A core justification for How NZ regulates offshore sportsbooks is the lack of consumer protection on overseas sites. When punters use unlicensed sites, they have no legal recourse if a dispute arises over a payout. The 2026 regulations mandate that all authorized NZ platforms must provide "Safer Gambling" tools, including age verification systems and the ability for players to close accounts without undue delay. Offshore sites often lack these measures, creating a higher risk of gambling-related harm.

Prohibited Financial Facilities

To further deter the use of high-risk offshore sites, the 2026 law prohibits certain payment methods for online gambling. Credit card deposits and "Buy Now Pay Later" (BNPL) facilities are strictly banned to prevent punters from betting with money they do not have. Licensed operators must also ensure that their user interfaces are clear and "not misleading"—a standard that many unregulated offshore sportsbooks fail to meet with their aggressive bonus structures and complex wagering requirements.

- Age Verification: Mandatory systems to ensure all users are 18+.

- Withdrawal Protections: Players must be able to withdraw remaining funds immediately.

- Single Account Rule: A player may only hold one account per platform to prevent multi-accounting.

- Bonus Clarity: Terms for bonuses and "free bets" must be expressed in plain language.

Age Verification: Mandatory systems to ensure all users are 18+.

Withdrawal Protections: Players must be able to withdraw remaining funds immediately.

Single Account Rule: A player may only hold one account per platform to prevent multi-accounting.

Bonus Clarity: Terms for bonuses and "free bets" must be expressed in plain language.

Extra-Territoriality and Enforcement Reality

The most significant change in How NZ regulates offshore sportsbooks is the "Extra-Territorial" effect of the law. This means that New Zealand's regulations apply to operators regardless of where they are physically located. While enforcing fines on a company based in Curacao or Malta can be challenging, the DIA uses a "multi-layered" blockade to neutralize their presence in NZ. By blocking their ads, restricting their payment options, and warning Kiwis that these sites are "breaking the law," the regulator effectively cuts off their customer supply.

The Impact on Kiwi Punters

For New Zealand-based bettors, the reality is that their favorite offshore site may suddenly become unavailable. If a provider has not obtained a license by 1 December 2026, they must exit the NZ market entirely. Punters are encouraged to move their funds to TAB NZ or the future 15 licensed casino platforms to avoid the risk of their offshore balance becoming inaccessible or unrecoverable. While playing on an offshore site is not technically a crime for the individual, doing so means you are interacting with a company that is acting unlawfully in New Zealand.

| Enforcement Action | Target | Outcome |

| Cease & Desist | Non-compliant offshore brands | Removal of NZ-facing services |

| Payment Blocking | Credit cards / BNPL | Friction in funding illegal accounts |

| ISP Take-downs | Unlawful gambling URLs | Site becomes inaccessible within NZ |

| Pecuniary Penalties | Serious offshore breaches | Fines of up to $5 Million |

Community Funding and the Monopoly Model

A major driver behind the regulation is the redistribution of gambling profits back into New Zealand communities. Under the current system, offshore bookmakers keep 100% of their net profits (minus the 12% duty), whereas TAB NZ distributes its profits to the racing and sporting industries. The 2026 licensing regime for casinos will follow a similar model, with an additional 4% of the online casino duty ring-fenced specifically for community projects.

Redirecting Millions Back Onshore

The government estimates that the new 2026 regulations could generate up to NZ$200 million in revenue. Between $10 million and $20 million of this is expected to go toward community projects in the first year alone. This model ensures that while gambling remains a high-risk activity, its financial output is used to strengthen New Zealand's teams and local infrastructure rather than enriching overseas shareholders.

- Sport NZ Funding: TAB NZ revenue supports over 30 sporting codes.

- Lottery Grants Board: Will distribute the ring-fenced 4% casino community return.

- Harm Prevention Fund: $81 million committed to gambling harm initiatives.

- Local Jobs: Onshoring the industry supports local compliance and tech roles.

Sport NZ Funding: TAB NZ revenue supports over 30 sporting codes.

Lottery Grants Board: Will distribute the ring-fenced 4% casino community return.

Harm Prevention Fund: $81 million committed to gambling harm initiatives.

Local Jobs: Onshoring the industry supports local compliance and tech roles.

Final Thoughts on NZ Offshore Regulation

The modernization of New Zealand's wagering laws in 2026 represents a victory for both domestic integrity and consumer safety. By dismantling the "grey market" and replacing it with a strict monopoly and a limited licensing system, the government has provided a clear, safe pathway for Kiwi punters. Understanding How NZ regulates offshore sportsbooks is vital for any bettor: it means recognizing that the law has prioritized your protection by mandating that only authorized domestic brands can handle your money. As the 15-license auction completes and the December 2026 deadline passes, the New Zealand betting arena will be one of the most well-regulated and community-focused markets in the world.

Ngā Pātai Auau (FAQ)

Is it legal for New Zealanders to bet on offshore sportsbooks in 2026? Technically, the act of placing a bet is not a crime for the individual, but it is unlawful for an offshore sportsbook to accept that bet. TAB NZ is the only legal provider for sports and racing betting.

What happens to offshore sites that don't have an NZ license by 1 December 2026? Unlicensed operators must exit the New Zealand market by this date or face severe penalties, including fines of up to $5 million.

Can offshore sportsbooks advertise on social media in NZ? No. Advertising offshore gambling is illegal, and using social media influencers to promote these brands is strictly prohibited and carries heavy fines.

Why did NZ ban offshore sportsbooks but allow 15 online casinos? The sports ban protects the funding model for NZ racing and sport. The 15 casino licenses allow for a controlled, taxable digital market for casino-style games.

What is the "Offshore Gambling Duty"? It is a 12% tax (rising to 16% in 2027) on the profits made by overseas online casinos from New Zealand residents.

How do I know if a betting site is authorized in NZ? Currently, only TAB and betcha are authorized for sports. From December 2026, 15 licensed casino platforms will also be authorized and must display a registration icon.

Can I use a VPN to access banned offshore sites? While you may technically be able to, doing so bypasses New Zealand's consumer protections. You will have no legal help if the site refuses to pay out your winnings.

Does the 2026 law prohibit credit card deposits for gambling? Yes. Credit card deposits and "Buy Now Pay Later" facilities are prohibited for all authorized online gambling platforms in New Zealand.

What is the penalty for an influencer promoting an offshore site? Individuals can face fines of up to $300,000 for breaching gambling advertising prohibitions.

Where does the money from NZ gambling taxes go? It is used for community projects, grassroots sports through Sport NZ, the racing industry, and gambling harm prevention initiatives.

1 DO FOLLOW EXTERNAL LINK: For a comprehensive historical overview and the full text of New Zealand's wagering legislation, visit the Gambling in New Zealand Wiki page.