Value betting in New Zealand is a sophisticated sports wagering strategy that relies on mathematical probability rather than subjective "gut feelings" or simple fandom. At its core, value betting occurs when a punter identifies a selection where the decimal odds offered by a bookmaker (primarily TAB NZ) represent a lower probability of an outcome occurring than the actual, true statistical likelihood of that event. By consistently placing wagers with a Positive Expected Value (+EV), bettors aim to secure a long-term mathematical edge over the house. This approach requires converting decimal odds into "implied probability" and comparing that figure against a rigorous personal or model-based assessment of the true chances of a result, such as an All Blacks victory or a specific NRL handicap cover. While variance ensures that no single bet is a guarantee of profit, the cumulative effect of backing undervalued odds is a proven path toward professional-grade wagering success in the New Zealand market.

The transition from a casual spectator to a value bettor in New Zealand involves a fundamental shift in perspective: viewing odds as prices for a commodity rather than just indicators of a winner. In the domestic market, TAB NZ acts as the primary market setter, utilizing complex quantitative models to establish their initial lines. However, these lines are often influenced by "public bias"—where high-profile teams like the All Blacks or the Warriors receive an influx of casual money, forcing the odds to drop below their "fair" value. A value bettor identifies these inefficiencies and wagers against the grain when the price is right. For instance, if the true probability of a cricket match ending in a home win is 50% (fair odds of 2.00) but the bookmaker offers 2.20, the bettor has found a 10% value margin. Mastering this concept is essential for any Kiwi punter looking to navigate the 2026 betting landscape with professional discipline.

- Definition of Value: A situation where the bookmaker's odds are higher than the true probability of the outcome.

- Positive Expected Value (+EV): The mathematical edge gained when you consistently back overpriced selections.

- Implied Probability: The percentage likelihood of a result as suggested by the decimal odds.

- Market Inefficiency: Occurs when public sentiment or bookmaker error results in mispriced odds.

Definition of Value: A situation where the bookmaker's odds are higher than the true probability of the outcome.

Positive Expected Value (+EV): The mathematical edge gained when you consistently back overpriced selections.

Implied Probability: The percentage likelihood of a result as suggested by the decimal odds.

Market Inefficiency: Occurs when public sentiment or bookmaker error results in mispriced odds.

The Mathematical Foundation of Value Betting

The bedrock of professional wagering in Aotearoa is the conversion of decimal odds into implied probability. In New Zealand, decimal odds are the universal standard, representing the total return for every $1 wagered. To find the implied probability of any TAB NZ line, you use the formula: 1/Decimal Odds×100. For example, a rugby team priced at 1.50 has an implied probability of 66.7%. Value is only found when your estimated "true probability" is higher than this figure. If your model suggests that the team actually has a 75% chance of winning, the 1.50 odds represent significant value.

Calculating Expected Value (EV)

To quantify the potential of a wager, punters calculate the Expected Value (EV). This reflects the average amount a bettor can expect to win or lose per bet placed on the same odds repeatedly. The formula is: (Probability of Winning×Profit per Win)−(Probability of Losing×Stake). A positive result indicates a profitable long-term opportunity, while a negative result signals a "sucker bet" where the house holds a mathematical advantage beyond the standard margin.

| Selection | Decimal Odds | Implied Probability | True Probability | Expected Value (EV) |

| Option A | 50.0% | 55.0% | +10% (+EV) | |

| Option B | 55.6% | 50.0% | -10% (-EV) | |

| Option C | 20.0% | 25.0% | +20% (+EV) | |

| Option D | 66.7% | 60.0% | -10% (-EV) |

Identifying Market Inefficiencies in New Zealand

Market inefficiencies are the "bread and butter" of value betting. In the New Zealand sports market, these typically arise from two sources: bookmaker error and emotional public betting. Bookmakers often set lines to balance their liabilities—meaning if 90% of the NZ public is betting on the All Blacks to cover a -15.5 point spread, the TAB may move the line to -18.5 to encourage betting on the opponent. This creates a value opportunity on the opponent, whose true probability of covering the now-inflated +18.5 spread is much higher than the odds suggest. Value bettors ignore the "who will win" question and focus entirely on "is the price right".

The Role of Niche Markets

While major markets like Super Rugby or the NRL are highly efficient due to the volume of data and betting interest, niche markets often house the greatest value. Regional cricket, domestic basketball (NBL), or specific player props for the Silver Ferns may not receive the same level of scrutiny from bookmaker quants. A punter who specializes in these areas can often develop a more accurate probability model than the bookmaker, leading to consistent identification of mispriced lines.

- Public Sentiment: Betting on popular teams drives odds down, creating value on the "unpopular" side.

- Specialization: Focusing on specific leagues allows you to spot errors in "soft" bookmaker lines.

- Line Movement: Tracking how odds change from the opening to the closing of a market.

- Situational Factors: Injuries, weather changes, or travel fatigue that the market has not yet fully "priced in".

Public Sentiment: Betting on popular teams drives odds down, creating value on the "unpopular" side.

Specialization: Focusing on specific leagues allows you to spot errors in "soft" bookmaker lines.

Line Movement: Tracking how odds change from the opening to the closing of a market.

Situational Factors: Injuries, weather changes, or travel fatigue that the market has not yet fully "priced in".

Implied Probability vs. True Probability

In the world of professional wagering, the only numbers that matter are the implied probability (what the bookmaker thinks) and the true probability (what you think). Implied probability is easy to find, but calculating true probability requires a rigorous approach. This involves analyzing historical data, recent form, injury reports, and situational metrics like home-field advantage or "travel fatigue" for teams crossing the Tasman. If the market implies a 40% chance of a Warriors win (odds of 2.50) but your data shows a 45% chance, the 5% difference is your "edge".

Normalizing for the Bookmaker Margin

Every set of odds in New Zealand includes a "margin" or "vig," which is how the TAB ensures profit. If you sum the implied probabilities of all outcomes in a match (e.g., Win, Draw, Loss), the total will be approximately 105%. The extra 5% is the house edge. To find the "true" implied probability as the bookmaker sees it, you must "normalize" the odds by removing this margin. This step is critical because it reveals the "break-even" point for your wagers.

| Sport | Typical Market | Implied Total (%) | House Margin (%) |

| Rugby Union | Head-to-Head | 105.5% | 5.5% |

| Cricket | Match Winner | 104.0% | 4.0% |

| NRL League | Point Spread | 106.0% | 6.0% |

| Football | 1X2 (Three-way) | 108.0% | 8.0% |

Staking Strategies for Value Betting

Finding a value bet is only half the battle; the other half is deciding how much to wager. A disciplined staking strategy is required to survive the natural variance of sports betting. The most popular method among value bettors is the Kelly Criterion. This mathematical formula determines the optimal size of a bet based on the size of your edge and the odds provided: Stake %=(Odds×Probability−1)/(Odds−1). By following a fractional Kelly strategy (betting only 25% or 50% of the suggested Kelly amount), punters can maximize long-term growth while protecting their bankroll from ruinous losing streaks.

Bankroll Management and Variance

Even with a 5% edge, it is mathematically possible to lose several bets in a row. This is known as "variance". Without proper bankroll management, a punter might go bust before their mathematical advantage can manifest over a large sample size of bets. Professional bettors never risk their entire bankroll on a single "lock," as the concept of a "sure thing" does not exist in the world of probability.

- Flat Staking: Betting the same amount on every value bet, regardless of the edge.

- Percentage Staking: Betting a fixed percentage of your current bankroll (e.g., 1-2% per bet).

- Kelly Criterion: Optimizing stake size based on the strength of the value identified.

- Loss Aversion: Maintaining discipline during "downswings" to avoid chasing losses.

Flat Staking: Betting the same amount on every value bet, regardless of the edge.

Percentage Staking: Betting a fixed percentage of your current bankroll (e.g., 1-2% per bet).

Kelly Criterion: Optimizing stake size based on the strength of the value identified.

Loss Aversion: Maintaining discipline during "downswings" to avoid chasing losses.

Using Historical Data to Estimate True Probability

To find value, you must be a better "oddsmaker" than the bookmaker in a specific niche. This requires a data-driven approach. Punters use historical results, advanced metrics (like "Expected Points" in rugby), and situational data to build their own probability models. For example, a model might reveal that a specific Super Rugby team wins 70% of their home games against Australian opponents when the temperature is below 15°C. If the TAB price for this scenario is 1.60 (implied 62.5%), the model has identified an 7.5% value edge.

The Importance of Closing Line Value (CLV)

One of the best ways to measure your success as a value bettor is by tracking your "Closing Line Value" (CLV). The closing line is the final set of odds offered by the bookmaker before the match begins, and it is widely considered the most accurate representation of true probability because it incorporates all available market information. If you consistently place bets at odds higher than the closing line (e.g., you bet at 2.10 and the odds close at 1.95), you are beating the market and will be profitable in the long run.

| Metric | Purpose | Importance |

| ROI | Measuring total return on investment | High |

| CLV | Comparing your odds to the final market price | Essential |

| Win Rate | Tracking the percentage of successful bets | Moderate |

| Yield | Profit relative to total amount staked | High |

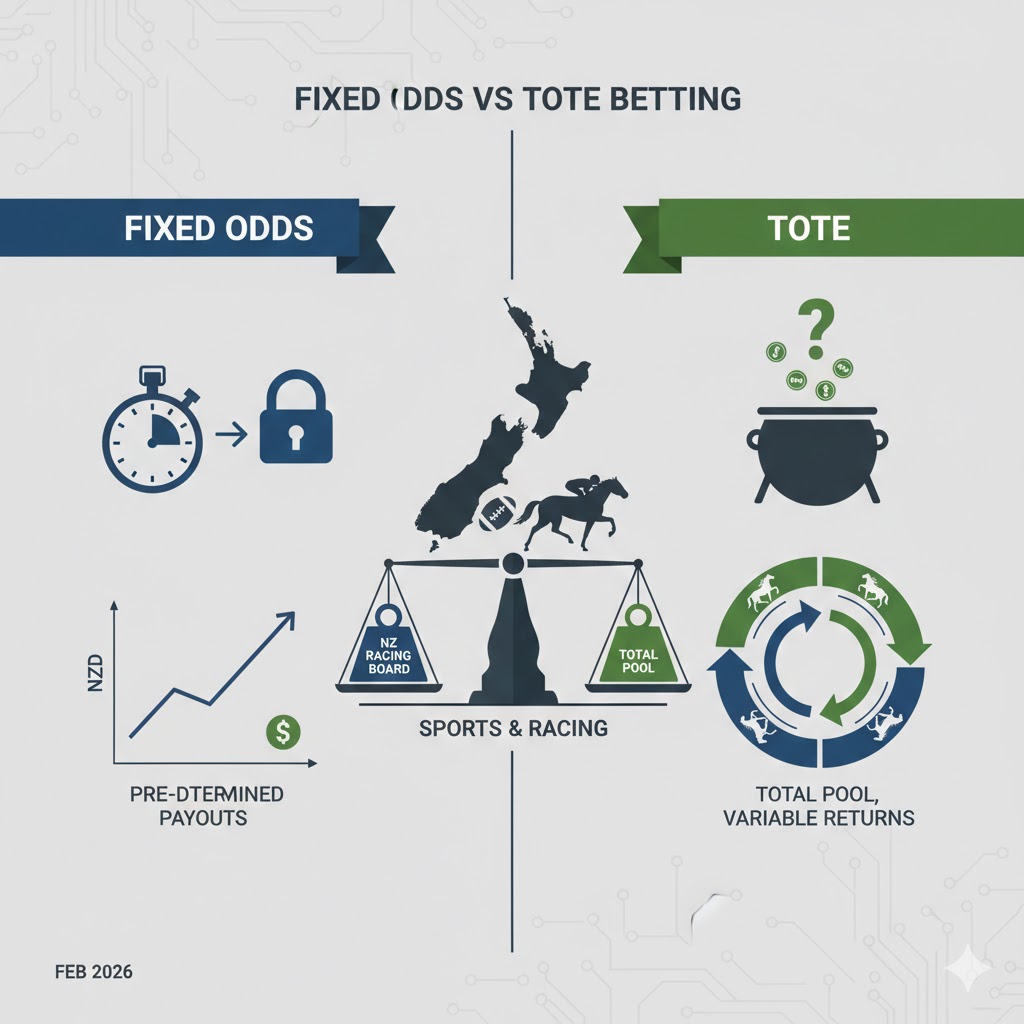

Fixed Odds vs. The Tote: Where is the Value?

In New Zealand, racing punters must choose between Fixed Odds and the Totalisator (Tote). Fixed Odds allow you to "lock in" the value at the time of your wager. If you identify a horse at 15.00 that your model says should be 10.00, taking the Fixed Odds ensures you get paid at the higher price even if the horse becomes the favorite by race time. The Tote, conversely, is a pool-based system where the final dividend is not known until the race starts. For value bettors, Fixed Odds are typically the preferred choice as they allow for precise Expected Value calculations.

The Perils of Tote Fluctuations

Because Tote odds change based on the volume of money entering the pool in the final minutes, they are susceptible to late "smart money" that can crush your value. A horse showing 8.00 on the screen might pay only 4.50 once the race jumps if a large syndicate places a late wager. While the Tote can occasionally provide higher dividends for long shots in large pools (like a Trifecta or Pick6), the lack of price certainty makes it difficult to implement a consistent mathematical value strategy.

- Price Certainty: Fixed odds provide a known return at the moment of the bet.

- Market Movement: Fixed odds reflect the bookmaker's reaction to betting volume.

- Pool Mechanics: Tote dividends are determined by the total pool minus commission.

- Dividend Variability: Tote prices often "crash" in the final seconds before a race starts.

Price Certainty: Fixed odds provide a known return at the moment of the bet.

Market Movement: Fixed odds reflect the bookmaker's reaction to betting volume.

Pool Mechanics: Tote dividends are determined by the total pool minus commission.

Dividend Variability: Tote prices often "crash" in the final seconds before a race starts.

Psychological Discipline in Value Betting

The greatest challenge for a value bettor is not the math, but the mindset. Value betting is a long-term strategy that requires ignoring short-term results. You may identify ten value bets in a weekend and lose eight of them; this does not mean the strategy failed, but rather that you experienced negative variance. A professional punter remains emotionally detached, knowing that as long as they continue to place +EV wagers, the mathematics will eventually normalize in their favor. Chasing losses is the ultimate "value killer," as it leads to irrational staking and the abandonment of probability-based decision-making.

Thinking in Probabilities, Not Winners

Most people bet on who they think will win. A value bettor bets on the price. This means you will often find yourself betting on underdogs or unpopular outcomes that you don't actually expect to win on a single-trial basis. If a 10.00 long shot has a 15% chance of winning, they are a massive value play (implied probability of only 10%), even though they will lose 85% of the time. The goal is to be right about the probabilities over a thousand bets, not the outcome of one match.

- Emotional Detachment: Treating every bet as a data point in a large set.

- Process over Outcome: Judging a bet by the quality of the odds taken, not the result.

- Patience: Accepting that "hot" and "cold" streaks are statistically inevitable.

- Objectivity: Removing personal fan bias from all betting evaluations.

Emotional Detachment: Treating every bet as a data point in a large set.

Process over Outcome: Judging a bet by the quality of the odds taken, not the result.

Patience: Accepting that "hot" and "cold" streaks are statistically inevitable.

Objectivity: Removing personal fan bias from all betting evaluations.

Tools and Software for Finding Value

In 2026, the competitive landscape has led to the development of sophisticated software that scans bookmaker lines in real-time to identify discrepancies. These "value betting tools" compare TAB NZ odds against "sharp" international bookmakers or betting exchanges (like Smarkets or Betfair) to highlight selections where the domestic price is significantly higher than the global consensus. Because sharp bookmakers have the most accurate models, any domestic price that deviates significantly from them is likely to contain value.

The Role of Betting Exchanges

Betting exchanges are invaluable for value bettors because they allow you to see the "pure" market price without the bookmaker's built-in margin. By looking at the "lay" odds on an exchange, you can see exactly what the global betting public believes the true probability is. If the TAB offers 2.10 for a result and the exchange "lay" price is 1.90, you have found a clear value edge that can be exploited for long-term profit.

| Tool Type | Function | Benefit |

| Odds Aggregators | Comparing prices across multiple providers | Ensures you get the best price |

| Betting Exchanges | Providing “sharp” market probability | Essential for verifying value |

| Kelly Calculators | Determining optimal stake sizes | Protects your bankroll |

| Value Scanners | Automated identification of mispriced lines | Saves time and finds niche edges |

Practical Examples of Value Betting in NZ Sports

To illustrate What is value betting in NZ, let's look at a typical Super Rugby scenario. Suppose the Hurricanes are playing the Brumbies at home. The TAB opens the Hurricanes at 1.40 (implied 71.4%). However, team news breaks that the Hurricanes' star fly-half is out with an injury. The market reacts slowly, and the odds remain at 1.40 for an hour. Your model, which accounts for the loss of a key playmaker, suggests the Hurricanes' true chance of winning has dropped to 65% (fair odds of 1.54). In this case, the 1.40 is a "Negative Expected Value" bet—even though they are likely to win, the price is not high enough to justify the risk. Conversely, the Brumbies' odds of 3.00 (33.3% implied) might now represent massive value if your model says they have a 35% chance.

Value in Asian Handicaps and Totals

Value isn't restricted to the match winner. Often, the most significant edges are found in "secondary" markets like Asian Handicaps or Over/Under points. For example, if a cricket ground in Christchurch is known for being a "batsman's paradise" but the Over/Under line is set low due to recent rain, a value bettor who knows the pitch dries quickly might find significant value in the "Over" market. These markets often have lower betting limits but offer more frequent mispricings than the high-profile Head-to-Head lines.

- Rugby League: Finding value in "Winning Margin" bands (e.g., 1-12 points).

- Cricket: Spotting "Top Batsman" value based on specific pitch conditions.

- Multi-Bets: Using value betting to identify +EV legs for a parlay (though risk is higher).

- Live Betting: Identifying value during a game based on momentum shifts the model hasn't caught.

Rugby League: Finding value in "Winning Margin" bands (e.g., 1-12 points).

Cricket: Spotting "Top Batsman" value based on specific pitch conditions.

Multi-Bets: Using value betting to identify +EV legs for a parlay (though risk is higher).

Live Betting: Identifying value during a game based on momentum shifts the model hasn't caught.

Consumer Protection and Responsible Value Betting

While value betting is a mathematical approach to profit, it is not without risk. Variance can be brutal, and even the best models can have "blind spots". In New Zealand, the Department of Internal Affairs (DIA) ensures that all authorized betting through TAB NZ is subject to strict consumer protection laws. Punters are encouraged to use "Safer Betting" tools, such as deposit limits and session timers, to ensure that their pursuit of +EV remains within their financial means. Value betting should be treated as a disciplined hobby or a secondary income stream, never as a desperate way to pay bills.

The Legality of Value Betting Tools

As of 2026, using value betting software and odds aggregators is perfectly legal in New Zealand. However, it is important to remember that TAB NZ, like all commercial bookmakers, monitors for "sharp" betting behavior. If a punter consistently bets on lines that move significantly in their favor (beating the closing line), the bookmaker may eventually limit their account to prevent significant losses. Value bettors often manage this by spreading their wagers across different markets and maintaining a low profile to avoid being flagged as professional "arbers" or value hunters.

| Feature | Description | Legal Status in NZ |

| Odds Scanners | Software that detects mispriced odds | Legal |

| Matched Betting | Using bonuses to lock in profit | Legal |

| Account Limiting | Bookmakers restricting winning accounts | Allowed by Terms |

| Safer Betting Tools | DIA mandated limit-setting tools | Mandatory |

Final Thoughts

Value betting in New Zealand is the ultimate expression of "betting with your head, not your heart". By mastering the conversion of decimal odds to implied probability and developing a rigorous method for estimating true likelihood, Kiwi punters can dismantle the house edge and build a sustainable long-term advantage. Whether you are a casual rugby fan looking to improve your returns or a dedicated quantitative analyst building Super Rugby models, the core principle remains the same: only wager when the price is in your favor. Success in this field requires infinite patience, mathematical precision, and the psychological fortitude to weather the inevitable storms of variance. In the 2026 betting landscape, value is the only true currency for the serious punter.

He Pātai Auau (FAQ)

What is the simplest definition of value betting? Value betting is placing a wager when the odds offered by a bookmaker are higher than the actual probability of the event occurring.

How do I calculate if a bet has value? Multiply your estimated true probability (as a decimal) by the bookmaker's decimal odds. If the result is greater than 1, you have found value.

Do I need expensive software to find value in NZ? No. While software can speed up the process, you can find value manually by specializing in a niche sport and building your own probability models based on historical data.

Is value betting the same as "matched betting"? No. Matched betting uses free bet promotions to lock in a guaranteed profit, whereas value betting relies on statistical edges and carries the risk of short-term losses.

What are decimal odds, and why are they used in NZ? Decimal odds (e.g., 2.50) represent the total return for a $1 stake. They are the standard in New Zealand because they are easy to calculate and convert into probability.

What is "Positive Expected Value" (+EV)? +EV is a mathematical term meaning that if you placed the same bet thousands of times, you would expect to make a profit on average.

Can TAB NZ limit my account for value betting? Yes. If you consistently beat the "closing line" (the odds just before a match starts), bookmakers may identify you as a "sharp" bettor and limit your maximum stake.

How much of my bankroll should I bet on a value selection? Most professionals recommend between 1% and 2% of your total bankroll per bet to protect against variance.

What is "Closing Line Value" (CLV)? CLV is a measure of how much higher your odds were compared to the final odds offered before the match began. Positive CLV is the best indicator of long-term success.

Is value betting legal in New Zealand? Yes. Value betting is a legitimate sports betting strategy and is perfectly legal within the authorized framework of TAB NZ and DIA regulations.

1 DO FOLLOW EXTERNAL LINK: For a comprehensive look at the legal framework and history of sports wagering in Aotearoa, visit the Gambling in New Zealand Wikipedia page.